Working Capital Turnover Ratio Ideal

4 lakh, then the turnover ratio is 5 (20,00,000/4,00,000). Working capital turnover is a ratio that quantifies the proportion of net sales to working capital, and it measures how efficiently a business turns its working capital into increased sales numbers.

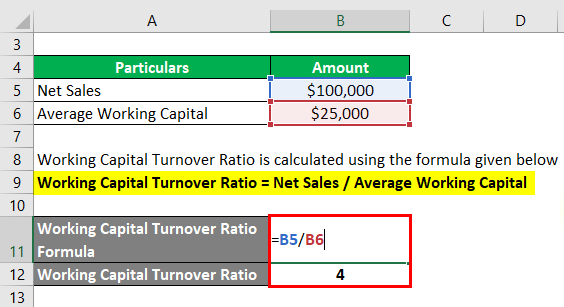

Working Capital Turnover Ratio Formula Calculator Excel Template

The working capital turnover is the ratio that helps to measure a company's efficiency in using its working capital to support sales.

Working capital turnover ratio ideal. Working capital turnover ratio is computed by dividing the net sales by average working capital. How to calculate your working capital turnover ratio. What is the ideal working capital ratio?

Take the next step to invest A positive turnover ratio means that a business is using its working capital justifiably. In this formula, the working capital is calculated by subtracting a company's current liabilities from its current assets.

Working capital turnover ratio is an efficiency ratio that measures the efficiency with which a company is using its working capital in order to support the sales and help in the growth of the business. Company a = $1,800/$340 = 20x; When the ratio is high, it indicates that the company is running smoothly and is able to fund its operations without additional sources of funding.

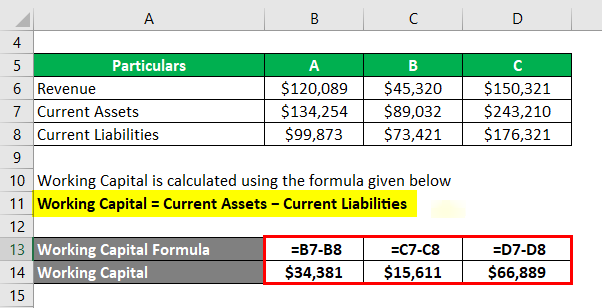

Calculate working capital by subtracting current liabilities from current assets. Working capital is very essential for the business. Capital turnover ratio indicates the efficiency of the organization with which the capital employed is being utilized.

Working capital turnover, also known as net sales to working capital, is an efficiency ratio used to measure how the company is using its working capital to support a given level of sales. Working capital turnover = net annual sales / working capital. Working capital turnover ratio = net sales / average working capital.

It measures how efficiently a business turns its working capital into increase sales. The working capital turnover is a ratio to quantify the proportion of net sales to working capital. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales.

This ratio shows the relationship between the funds used to finance the company’s operations and the revenues a company generates in return. This ratio is also known as net sales to working capital and shows the relationship between the revenue generated by the company and the funds needed to generate this revenue. It is defined as the difference between the current assets and current liabilities and working.

Net sales / (total assets minus total liabilities) in this way, the amount of sales is directly related to the company’s current assets and liabilities. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a. What this means is that company a was more efficient in generating revenue by utilizing its working capital.

Generally, a working capital ratio of less than one is taken as indicative of potential future liquidity problems, while a ratio of 1.5 to two is. For example, if a company $10 million in sales for a calendar year $2 million in working capital, its working capital turnover ratio would be $5 million ($10 million net annual sales divided by $2. Now that we know all the values, let us calculate the working capital turnover ratio for both the companies.

Net annual sales divided by the average amount of working capital during the same year. The working capital turnover ratio is calculated as follows: A working capital turnover ratio exceeding 30.0 generally highlights needing more working capital for the future.

It shows company’s efficiency in generating sales revenue using total working capital available in the business during a particular period of time. Working capital of a business is the difference in values of its current assets and its current liabilities. Working capital is current assets minus current liabilities.

This means that every dollar of working capital produces $6 in revenue. As a result, the working capital turnover ratio will be 5. When managing cash flow, however, the most important skill is to be ahead of the game.

A low or reducing quick ratio is a sign that the business is consuming cash faster than it can earn it, which is only sustainable for a limited amount of time. Working capital turnover ratio = net sales/working capital = 1,50,000/50,000 = 3/1 or 3:1 or 3 times. High and low working capital turnover

This shows that for every 1 unit of working capital employed, the business generated 3 units of net sales. Higher the capital turnover ratio better will be the situation. The working capital turnover ratio formula is as follows:

45 lakh and average working capital rs. What is working capital turnover ratio? Too high of a ratio could signal that there isn’t enough available working capital to support sales growth.

The working capital turnover ratio reveals the connection between money used to finance business operations and the revenues a business produces as a result. A high capital turnover ratio indicates the capability of the organization to achieve maximum sales with minimum amount of capital employed. If the annual turnover of a business is rs.

The working capital turnover ratio is thus $12,000,000 / $2,000,000 = 6.0. Conversely, too low of a ratio could suggest ineffectively employed working capital.

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio - Formula Example And Interpretation

Working Capital Turnover Ratio - Formula Example And Interpretation

Working Capital Turnover Ratio - Formula Example And Interpretation

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

How To Calculate Working Capital Turnover Ratio - Flow Capital

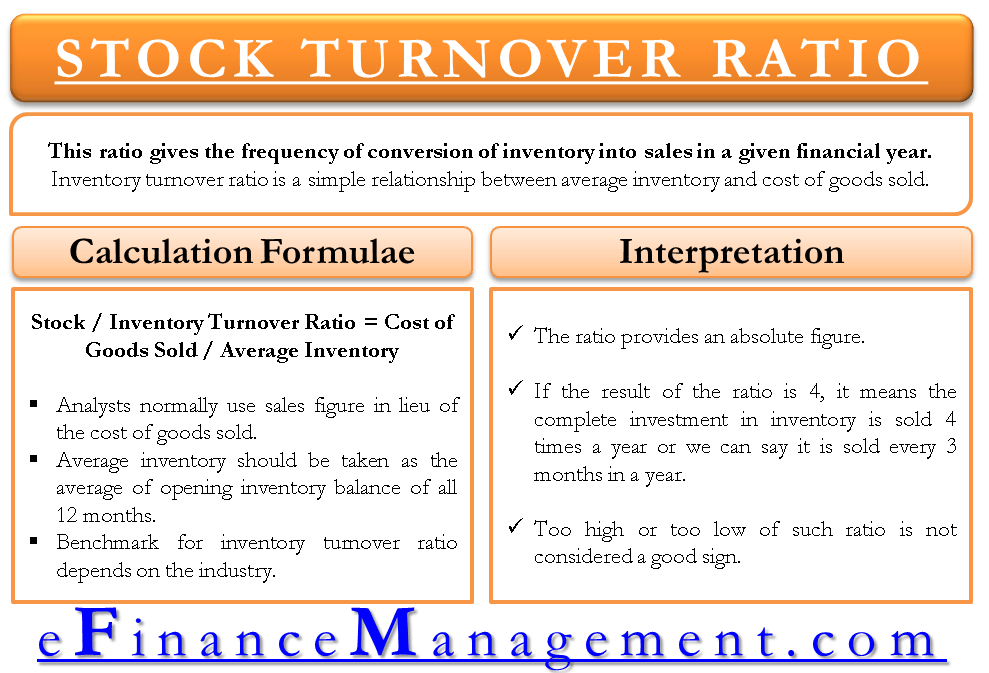

Stock Inventory Turnover Ratio - Calculate Formula Benchmark

Capital Turnover - Definition Formula Calculation

Working Capital Turnover Efinancemanagementcom

Working Capital Turnover Ratio Different Examples With Advantages

Dr Marie Bani Khalid Dr Marie Banikhaled - Ppt Download

Working Capital Turnover Ratio Double Entry Bookkeeping

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Different Examples With Advantages

What Is Working Capital Turnover Ratio - Accountingcapital