What Is Net Change In Working Capital

Companies need working capital to survive, to continue with their operations; Net working capital is also known simply as “working capital.”

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)

Working Capital Definition

Examples of changes in working capital if a company's owners invest additional cash in the company, the cash will increase the company's current assets with no increase in current liabilities.

What is net change in working capital. Working capital can be divided into two categories: It is a necessary ingredient. The above increase or decrease in working capital can be represented with the help of the following example:

Net working capital is the aggregate amount of all current assets and current liabilities. Positive working capital is the excess of current assets over current liabilities. So a positive change in net working capital is cash outflow.

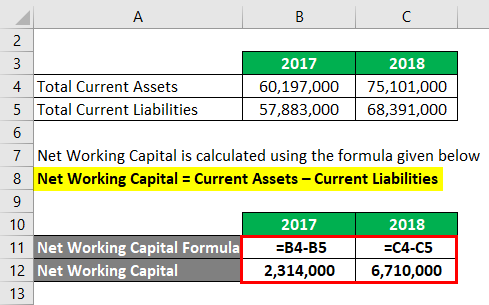

Net working capital (nwc) is current assets minus current liabilities. Any change in the net working capital refers to the difference between the net working capital of two executive accounting periods. Simply put, net working capital (nwc) is the difference between a company’s current assets current assets current assets are all assets that a company expects to convert to cash within one year.

Working capital is a balance sheet definition that only gives us a value at a certain point in time. If the change in nwc is positive, the company collects and holds onto cash earlier. As a business, your aim is to reduce an increase in the net working capital.

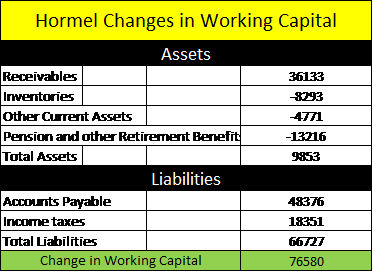

What are changes in net working capital? However, if the change in nwc is negative, the business model of the company might require. The ccc is a tool used to highlight the flow of dollars into current assets and from current liabilities.

Net working capital is therefore higher if the current assets are higher or the current liabilities are lower. I) increase in cash of $500 ii) increase in accounts receivables of $800 ii) decrease in inventories of $350 iv) decrease in prepaid expenses of $225 v) increase in pp&e of $950 vi) increase in accounts payable of $400 $175 In the example above, the seller would recognize a positive purchase price adjustment of $25,000.

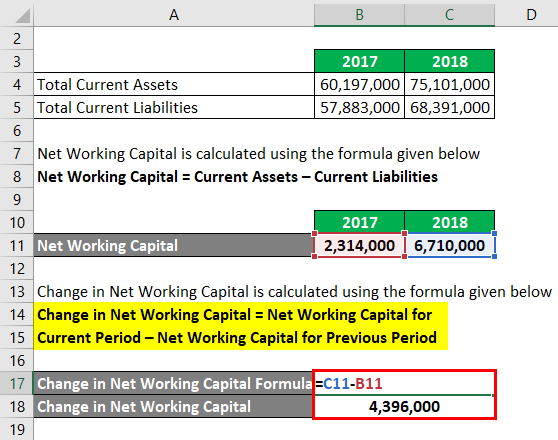

Similarly, change in net working capital helps us to understand the cash flow position of the company. How do you calculate change in net working capital? Now suppose land and building is sold for rs.

What is net working capital? A management goal is to reduce any upward changes in working capital, thereby minimizing the need to acquire additional funding. A change in working capital is the difference in the net working capital amount from one accounting period to the next.

Current assets and current liabilities are calculated to calculate change in net working capital. In other words, when the net working capital is a positive figure, it is said that the firm has a positive working capital. While the general concept may be generally understood and would appear easy by way of the above example, this is a topic that is heavily debated and becomes increasingly.

What accounts are included in net working capital? They are commonly used to measure the liquidity of a and current liabilities current liabilities current liabilities are financial obligations of a business entity that are due and payable within a year. In the above example, working capital becomes rs.

Changes in working capital is an idea that lives in the cash flow statement. Net working capital is defined as current assets minus current liabilities. Net working capital, which is also known as working capital, is defined as a company's current assets minus itscurrent liabilities.

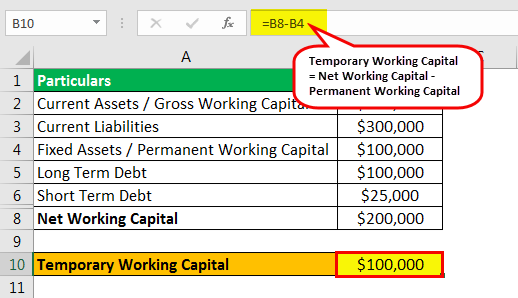

Gross working capital and net working capital. Now let us discuss results: Gross working capital gross working capital is a measure of a.

What is net working capital? Working capital, also known as net working capital (nwc), is the difference between a company’s current assets—such as cash, accounts receivable/customers’ unpaid bills, and. What does change in nwc mean?

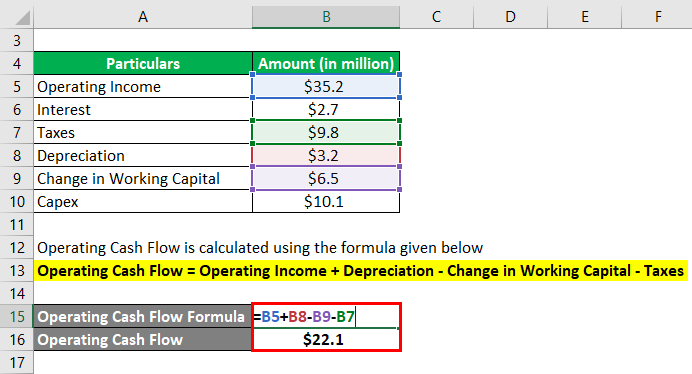

What is the working capital formula? The change in net working capital (nwc) section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Or even if it is positive, should require more capital than microsoft to grow in absolute terms.

Net working capital is defined as current assets minus current liabilities. I) increase in cash of $500 ii) increase in accounts receivables of $800 ii) decrease in inventories of $350 iv) decrease in prepaid expenses of $225 v) increase in pp&e of $950 vi) increase in accounts payable of $400 Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in.

A change in working capital is the difference in the net working capital amount from one accounting period to the next. This is because an increase in the net working capital would mean additional funds needed to finance the increased current assets. It’s also important for predicting cash flow and debt requirements.

So if the change in net working capital is positive, it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. I) increase in cash of $500 ii) increase in accounts receivables of $800 ii) decrease in inventories of $350 iv) decrease in prepaid expenses of $225 v) increase in pp&e of $950 vi) increase in accounts payable of $400

Working Capital Example Formula - Wall Street Prep

Is A House An Asset Or Liability - Online Accounting

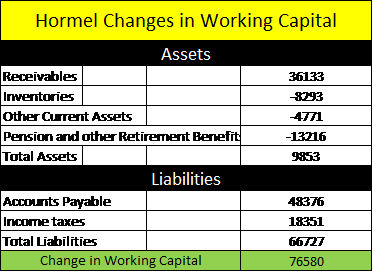

Changes In Net Working Capital All You Need To Know

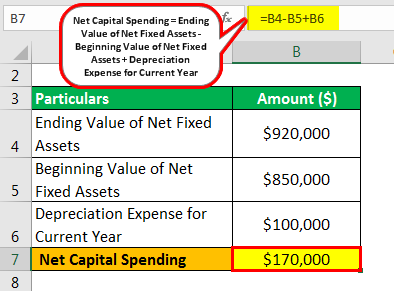

Net Capital Spending Formula Example How To Calculate

10 Of 14 Ch10 - Change In Net Working Capital Nwc Explained - Youtube

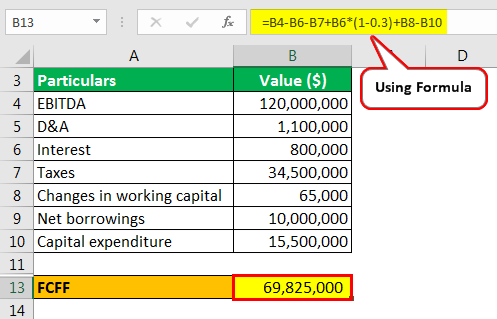

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Working Capital Example Formula - Wall Street Prep

Types Of Working Capital Gross Net Temporary Permanent Efm

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Net Working Cap It Network Capital Finance Management

How Do Net Income And Operating Cash Flow Differ

Working Capital Examples Top 4 Examples With Analysis

Cash Flow Formula How To Calculate Cash Flow With Examples

Why You Need To Know The Working Capital Formulation And Ratio - India Dictionary

How To Find And Calculate Changes In Working Capital For Owners Earnings

Working Capital Example Formula - Wall Street Prep

Net Working Capital Template - Download Free Excel Template

Working Capital Example Formula - Wall Street Prep